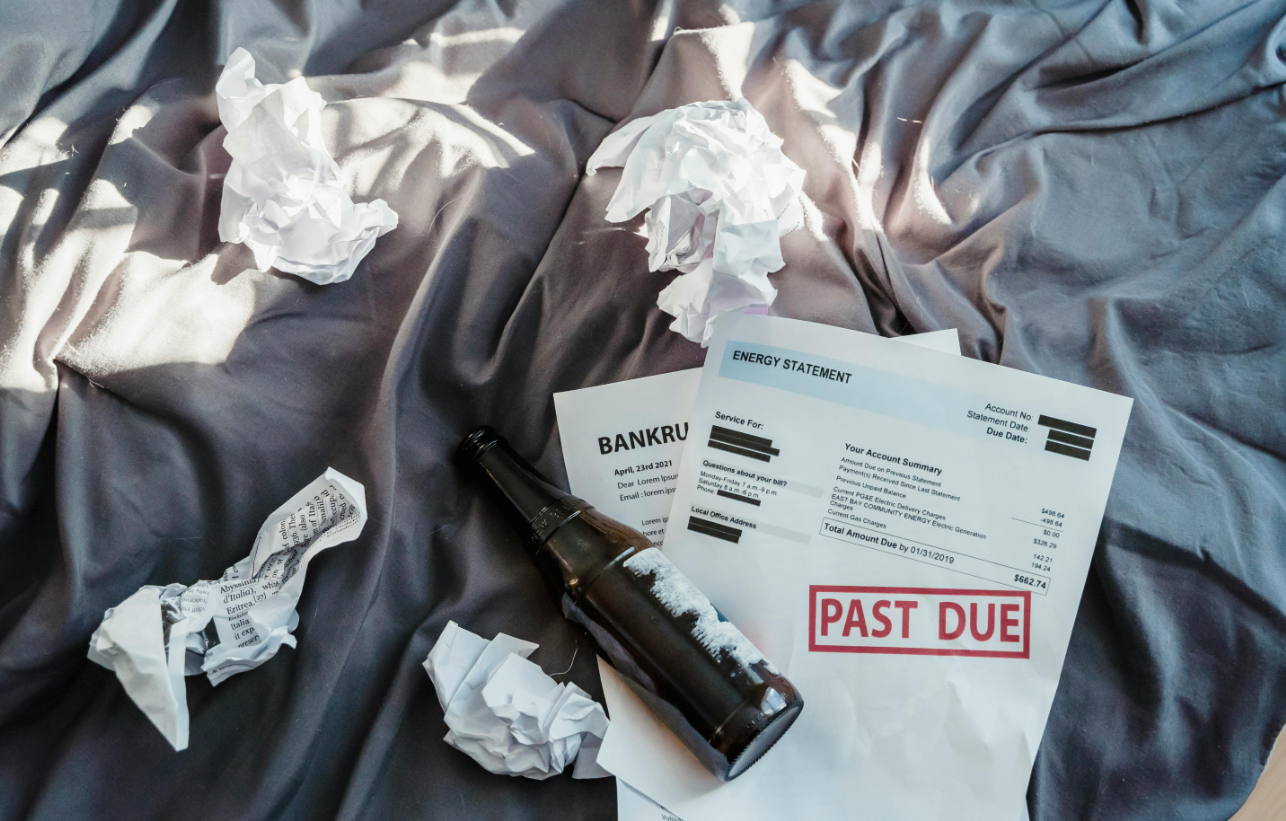

Facing bankruptcy is tough. It feels like a storm hit your life. But there is hope. Bankruptcy in Orlando can be the first step toward rebuilding your credit. You are not alone. Many people in Orlando and Kissimmee face this challenge. Bankruptcy offers a chance at a clean slate. There is no need to feel ashamed. Instead, focus on moving forward. Here’s how you can start fresh. First, understand your situation. Learn about your financial standing. Then, create a plan. This plan should include budgeting and managing your expenses. Next, consider opening a secured credit card. This can help build your credit score again. Finally, keep track of your progress. Celebrate small victories along the way. Each step brings you closer to financial stability. Remember, recovery is possible. You have the power to rebuild. With patience and determination, you can achieve a brighter financial future.

Understand Your Credit Report

Begin by obtaining a copy of your credit report. This report is crucial. It shows your financial history. Inaccuracies can be corrected. Visit Annual Credit Report to get your free copy. Check all details carefully. Look for errors. Report any mistakes to the credit bureau. This ensures your report is accurate. Correcting errors can improve your score quickly.

Create a Realistic Budget

A practical budget is essential. List your income and expenses. Include all bills and debts. Identify areas where you can cut costs. Saving even small amounts helps. Prioritize necessary expenses first. Use tools like Consumer.gov for budgeting guidance. Stick to your budget consistently. This discipline will pay off.

Choose the Right Credit Options

To rebuild your credit, consider a secured credit card. Banks offer these cards with a deposit. The deposit serves as your credit limit. Use this card responsibly. Make small purchases and pay them off each month. This shows lenders you are reliable.

Track and Celebrate Your Progress

Keep a close eye on your credit score. Use free services to monitor changes. Celebrate each improvement. Positive reinforcement keeps you motivated. Remember, rebuilding credit takes time. Patience is key.

Comparison of Credit Rebuilding Options

| Option | Pros | Cons |

| Secured Credit Card | Easy approval, builds credit history | Requires a deposit, low credit limit |

| Credit-builder Loan | No credit check, boosts credit score | Often high fees, takes time |

| Authorized User | Improves score immediately, no responsibility | Depends on primary user’s credit behavior |

Conclusion

Rebuilding credit after bankruptcy is a journey. But it’s a journey worth taking. With a clear plan and persistent effort, you can regain financial health. Utilize available resources and tools. Trust in the process. You can overcome these challenges. In Orlando and Kissimmee, many have walked this path successfully. You can too. Stay focused and be patient. Your brighter financial future awaits.